oklahoma car sales tax calculator

Its fairly simple to calculate provided you know your regions sales tax. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Sales Tax On Cars And Vehicles In California

How to Calculate Oklahoma Sales Tax on a New Car.

. Oklahoma Vehicle Sales Tax Fees Find The Best Car Price If the purchased price falls within 20 of the Blue Book value then the purchase price will be used. This method is only as exact as the purchase price of the vehicle. The county the vehicle is registered in.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tulsa Oklahoma. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Oklahoma has a lower state sales tax than 885.

The value of a vehicle is its actual sales price. Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard. 325 percent of purchase price.

Free calculator to find the sales tax amountrate before tax price and after-tax price. Oklahoma charges two taxes for the purchase of new motor vehicles. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

There are special tax rates and conditions for used vehicles which we will cover later. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average.

125 sales tax and 325 excise tax for a total 45 tax rate. Tax and Tags Calculator Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. The easiest way to do this is by.

Dealership employees are more in tune to tax rates than most government officials. 45 percent of the purchase price minimum 5. Office 918591-3099 fax 918 591-3098 Email us.

Mortgage Loan Auto Loan Interest Payment Retirement Amortization. The cost for the first 1500 dollars is a flat 20 dollar fee. Sales tax in Tulsa Oklahoma is currently 852.

Our free online Oklahoma sales tax calculator calculates exact sales tax by state county city or ZIP code. Sales Tax Rate s c l sr. Also check the sales tax rates in different states of the US.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. 20 up to a value of 1500 plus 325 percent on the remainder.

If the purchased price falls within 20 of the Blue Book value then the purchase price will be used. Registration fees are. The excise tax is 3 ¼ percent of the value of a new vehicle.

Tax rates are calculated differently for each category of vehicle. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. 2000 x 5 100.

The excise tax is 3 ¼ percent of the value of a new vehicle. In Oklahoma this will always be 325. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325.

Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of their purchase price provided that purchase price is within 20 of the average retail value for that specific model. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Your exact excise tax can only be calculated at a Tag Office.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. If you are unsure call any local car dealership and ask for the tax rate. 20 up to a value of 1500 plus 325 percent on the remainder value.

Once you have the tax rate multiply it with the vehicles purchase price. The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change. Whether or not you have a trade-in.

There is also an annual registration fee of 26 to 96 depending on the age of the. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. 325 percent of purchase price.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa Oklahoma Sales Tax Comparison Calculator for 202223. How to Calculate Oklahoma Car Tax - CarsDirect.

So whilst the Sales Tax Rate in Oklahoma is 45 you can actually pay anywhere between 45 and 10 depending on the local sales tax rate applied in the municipality. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top.

The Motor Vehicle Excise Tax on a new vehicle sale is 325. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. How much is tax on a used car in Oklahoma.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special taxation districts. How Much Is the Car Sales Tax in Oklahoma. The state in which you live.

The type of license plates requested. You can use our Oklahoma sales tax calculator to determine the applicable sales tax for any location in Oklahoma by entering the zip code in which the purchase takes place. Multiply the vehicle price after trade-ins and incentives by the sales tax fee.

Calculating Sales Tax Summary. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. You may also be interested in printing a Oklahoma sales tax table for easy calculation of sales taxes when you cant access this calculator.

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Fl Sales Tax On Rent

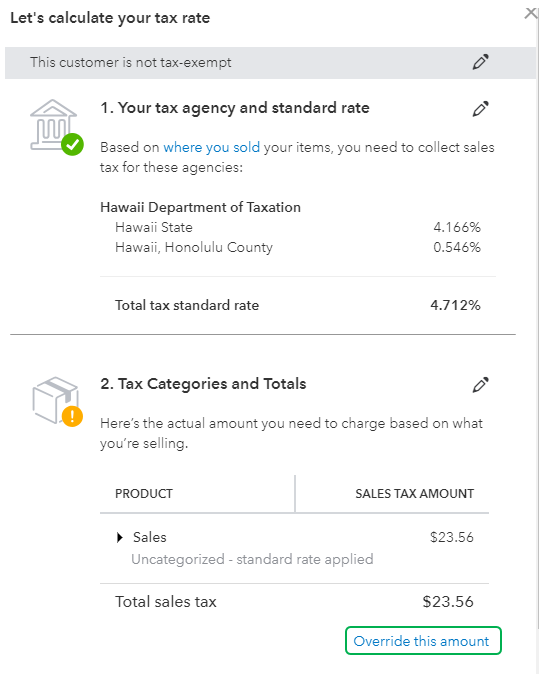

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

New York Sales Tax Everything You Need To Know Smartasset

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Individual Income Tax Oklahoma Policy Institute

Missouri Car Sales Tax Calculator

Texas Used Car Sales Tax And Fees

Car Tax By State Usa Manual Car Sales Tax Calculator

Oklahoma Property Tax Calculator Smartasset

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price